Is 2022 the time to “cash in” on the inflated value of your car?

Used cars have seen an incredible jump in value over the last 12 months, with many cars increasing in value.

The used car market is without doubt artificially over-priced. There is only one reason for this, under-supply of new cars. With most analysts suggesting this new car supply chain bottleneck will ease during 2022, we are likely to see a significant correction in used car prices later in 2022.

A client journey:

One of our clients bought their Porsche Macan in May 2018 for £53,000. This was a diesel car, so one could expect that given the clamour against diesels since this period, the value would depreciate by around 5-20% each year after 3 years of ownership, dependent on how many miles were being driven.

The finance company projected (an admittedly conservative) residual value for May 2022 of £20,911.

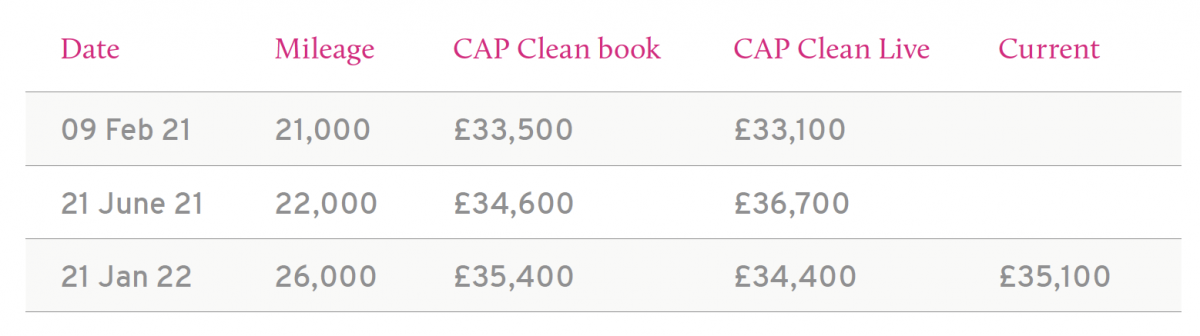

As the figures below show, as time has passed, the age of the car has increased, and the mileage has increased; so too has the value of the car, with something like an 8-10% increase on this particular example.

How does this affect your next car purchase or lease?

With lead times currently far longer than normal, many of our clients are considering if it may be simpler to buy a used vehicle. This is something we typically help with, with normal years around 10% of our business being in used cars. However, at present used cars represent a far bigger risk than new, with the likelihood being that any purchase now would see clients buying way over “true” value, and a real chance of significant additional negative equity to come. This is before one considers higher running costs from being a used car, the tyres will need replaced earlier, MOTs and warranty expirations will come about earlier, and so on.

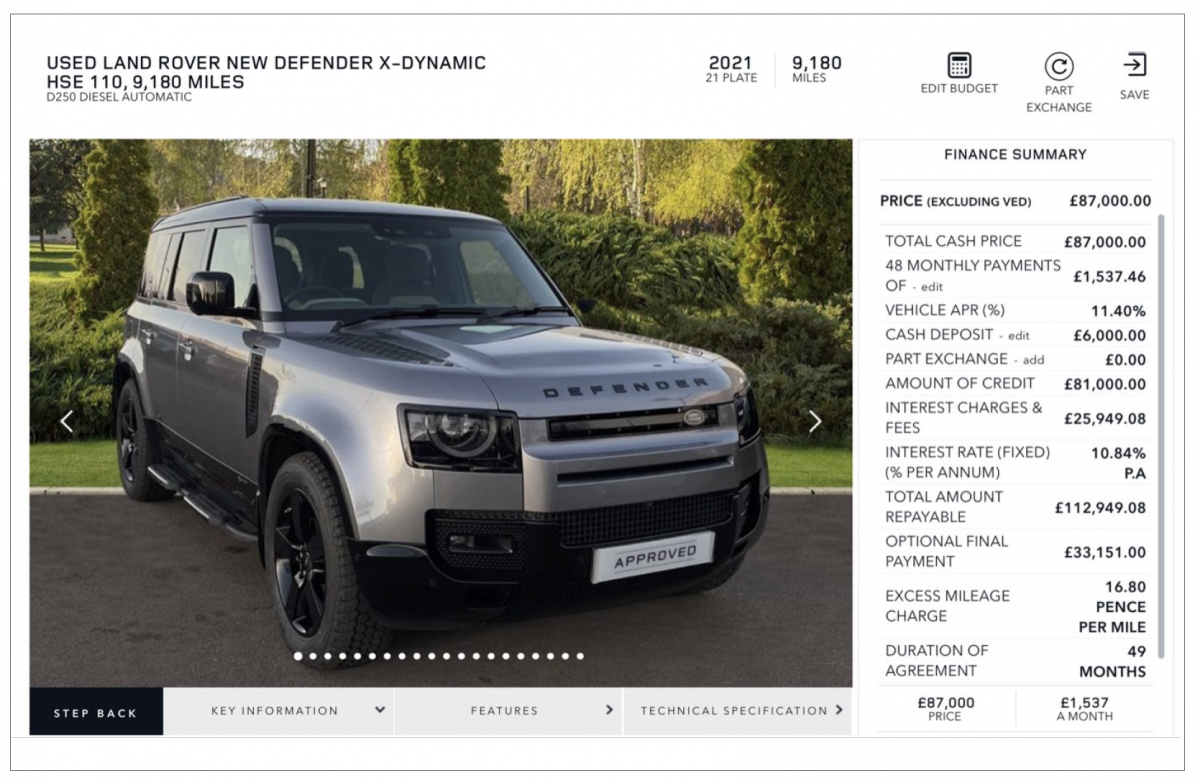

The ‘cost when new’ figure of 12 months ago was £63,860 (perhaps excluding a few of the extras), so lets assume it was £65,000.

- Now, 12 months later, you can buy this car that is a year old, and with nearly 10,000 miles on the clock, for over £20,000 more than it cost new.

- Even if one assumes that inflationary pressures will remain over the next 12 months, and therefore the car doesn’t depreciate quite to its normal point, it is reasonable to suggest this car could be worth around £40-45,000 (it is a diesel Land Rover don’t forget), meaning it could cost you circa. £4,000 per month in depreciation, and that is before you factor in any cost of financing.

- Note also, if you were to buy this car as offered, you’d be paying 11.4% APR interest on your car finance, meaning the likelihood of significant negative equity is extremely high.

Conclusion:

The message from us is clear. Despite long lead times, and inflationary pressures on new cars, it is the short-term used car market which represents the greatest risk to clients in 2022. Pike + Bambridge has almost completely exited from the used car market for 2022 despite it previously accounting for 10% of our business, as we do not feel clients are returning any significant medium-term value.

If you do own a used car outright, and particularly a diesel car which has greater residual risk over the next 1-2 years, it is worth considering ‘cashing in’ the value on this car reasonably urgently, particularly given any replacement may well be a number of months away.