The automotive industry, particularly the electric market, seem to be the hot topic for media organisations, sports sponsorships and investors, but it is in the staid world of tax that the most immediate benefit lies for business owners.

Let us say this first: electric cars are not for everyone. The range isn’t as long as it will be in the future, there are teething problems with new technologies, and the infrastructure, particularly in rural areas has a long way to go before being ready to support the 35 million cars on UK roads.

But, and there is always a but… The cost savings for business owners are HUGE. There are simply too many to ignore with the current tax regime and grant structure. It has to be worth consideration.

Quick disclaimer: At P+B, we’re passionate about changing the way people buy cars, and that includes switching the professional world to electric cars by 2030. However, the process of supplying an electric car is actually more complicated, and therefore expensive, for us than the typical combustion engined car. There is more advice, more need for demonstrations and generally a longer lead time for the cars.

Despite all this, we absolutely believe every business owner and business should be reviewing their personal car and their company car policy (including cash allowance). Here is why:

Benefit in Kind (BIK) Changes

We’ve blogged about this before, and indeed published white papers with our official partner ICAS highlighting just how much the changes in April 2020 have moved the goalposts for electric cars and the tax benefits of running them through a business.

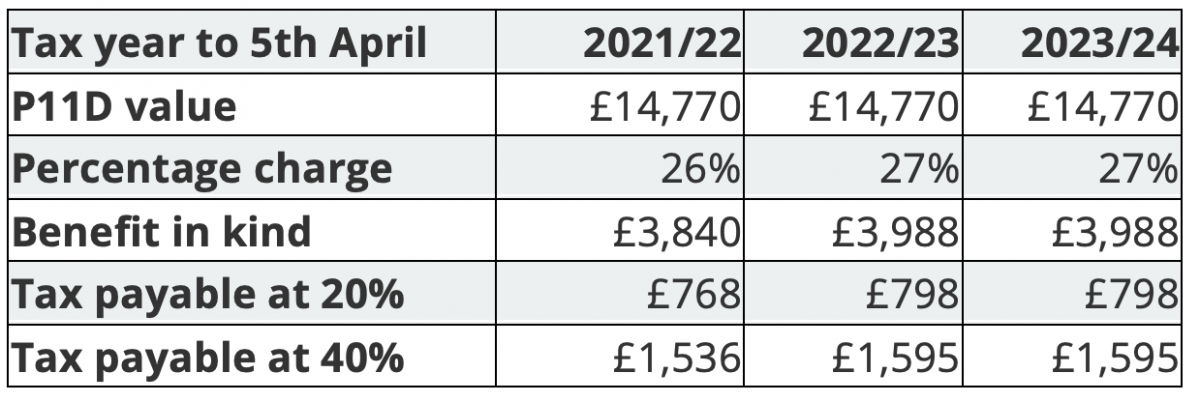

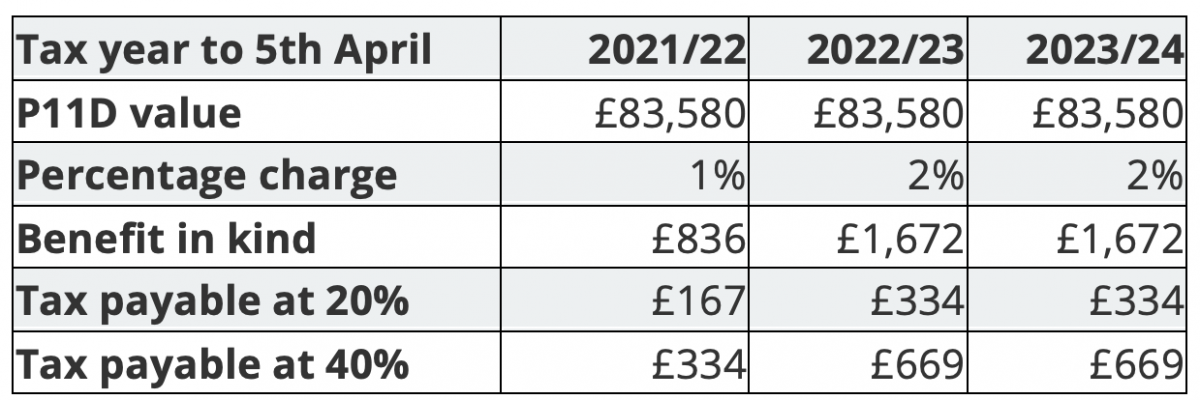

Put simply, see below for a comparison on two vastly different cars and the benefit in kind (BIK) tax (company car tax) payable on each:

Firstly, the Fiat 500 1.0 Mild Hybrid Connect 70hp, a great small car, with a circa £15,000 list price.

As a 40% tax payer you would pay £1,536 in BIK this year to run this personal car through your business.

As a 40% tax payer you would pay £1,536 in BIK this year to run this personal car through your business.

Now consider the £83,000 car, the Porsche Taycan, a fully electric car.

That is correct, you’ll pay £334 in BIK tax as a 40% tax payer on this car.

Obviously, most business owners are not driving around in Fiat 500s financed through their business. Assuming you follow the prevailing wisdom of running the car personally and claiming business mileage, consider this - the average business owner will pay themselves 30-40% more in gross salary or dividends than their net car payment costs them. So your £450 per month PCP agreement is probably costing you circa. £700-800 pre-tax. You should also consider:

- Fuel Savings: Obviously with electric cars costing anywhere between 25% and 40% of combustion-engined cars to run, there is a significant cost reduction in running the vehicle.

- Insurance, Maintenance: If you do currently run your car personally and claim mileage, all the costs related to insurance.

- Grants: There are 2 main grants for electric cars at present.

The plug-in car grant of £2,000 applies to all cars up to £35,000, and is predicted to be withdrawn completely over the next 12 months.

There is also various levels of grant support for installing chargepoints in your home or office. In Scotland, there is additional support from the Energy Saving Trust.

It is important to note, we don’t profess to be tax advisors, but in the narrow field of fleet management, we’ve been working with businesses and their professional advisors for a decade, and the case for electric cars from a tax perspective is indisputable.

What you then need to do is consult an expert who can advise you on the pitfalls, the possible issues that living with electric might give you, and whether hybrid may be a better fit for the immediate future.

That is what our Business Concierge team specialises in, and works with business owners on a faily basis to support with.

Get in touch now to review the benefits and see if now may be the time after all, to make the switch to electric.