In whatever walk of life you move in this summer, it feels like delays to deliveries and price increases are the flavour of the month. When even Amazon can be seen struggling to deliver kitchen roll, as the author experienced recently, we know we are in a time of supply chain pressures. The UK is experiencing a combustible combination of patchy supply, paired with post-lockdown surges in demand in everything from garden furniture to concrete, with the inevitable consequence being price increases.

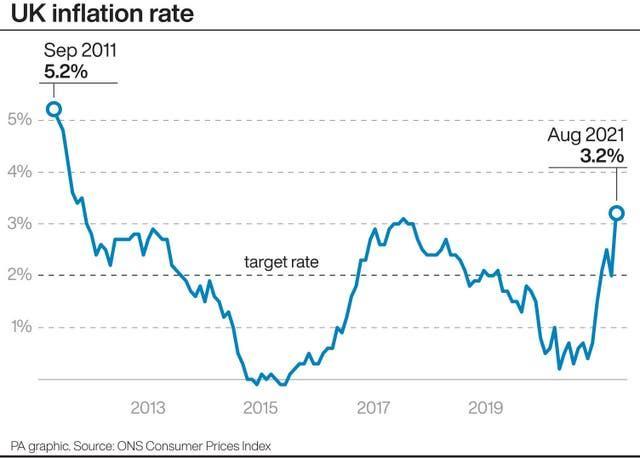

Inflationary pressures on the economy are somewhat of a novelty over the last decade, with June’s 2.5% rate of inflation being the highest rate seen in the UK economy for 3 years (albeit we then saw a slight drop in July). The typical Bank of England response to inflationary rises is to increase interest rates, and while we are some way ahead of this, the impact on the automotive industry of interest rate rises is something very few have considered.

The automotive industry is no exception to the increased supply and demand, leading to a price increase climate. BMW, Mercedes, Audi and Volvo are among many manufacturers to have issued a price increase ‘mid-quarter’ rather than the more planned model year price changes we typically see.

Some manufacturers have packaged this price rise as a ‘reduction in discount’ but the effect on car finance prices is similar.

Fortunately, the historically low interest rates we see from the Bank of England mean this continues to be an attractive time to finance a vehicle, particularly when compared to the pre-2008 crash which saw base interest rates up at 5.75% and many car finance products typically price in the 8-10% range.

Some manufacturers have the ability to cushion the market against interest rate rises, with essentially having their own ‘banks’ such as Mercedes Finance or the industry behemoth, VW Financial Services. However, expect this support to be limited by the multiple headwinds buffeting the industry, leaving manufacturers short on margin to share out to further support new car sales.

.jpg)

That interest rates will rise eventually is something of a certainty. Only in the last decade has the average interest rate been below 4%, with previous decades seeing as high as 9% averages in the 1980s.

The modern car buyer is far more exposed to these pressures than previous times of high interest rates, with over 80% of new cars now sold with a car finance product attached.

Locking in interest rates whilst they are low over the coming months and years does make sense, given many people’s reluctance to buy the current automotive technology outright in cash, with so much uncertainty about what the residual values will look like.

As ever, Team P+B are here to support clients through the myriad of options around car buying and finance. With everything from what car suits your needs, to support with electric car chargepoint installation, we’re on your side.