At present there are a number of hybrid vehicles which offer substantially improved opportunities for business owners to mitigate tax.

The benefits of driving a hybrid vehicle

The hybrid model of the new Range Rover offers an electric range of 69 miles, meaning the car will qualify for 8% benefit in kind tax in the 2022-23 tax year. Business owners can take advantage of a combination of savings in both corporation tax and VAT on the lease of the car, with all maintenance, tyres and insurance included. This is balanced with only 8% benefit in kind tax, due to the EV range, meaning if you’re looking for a premium SUV, this a very compelling vehicle for senior business leaders to consider”.

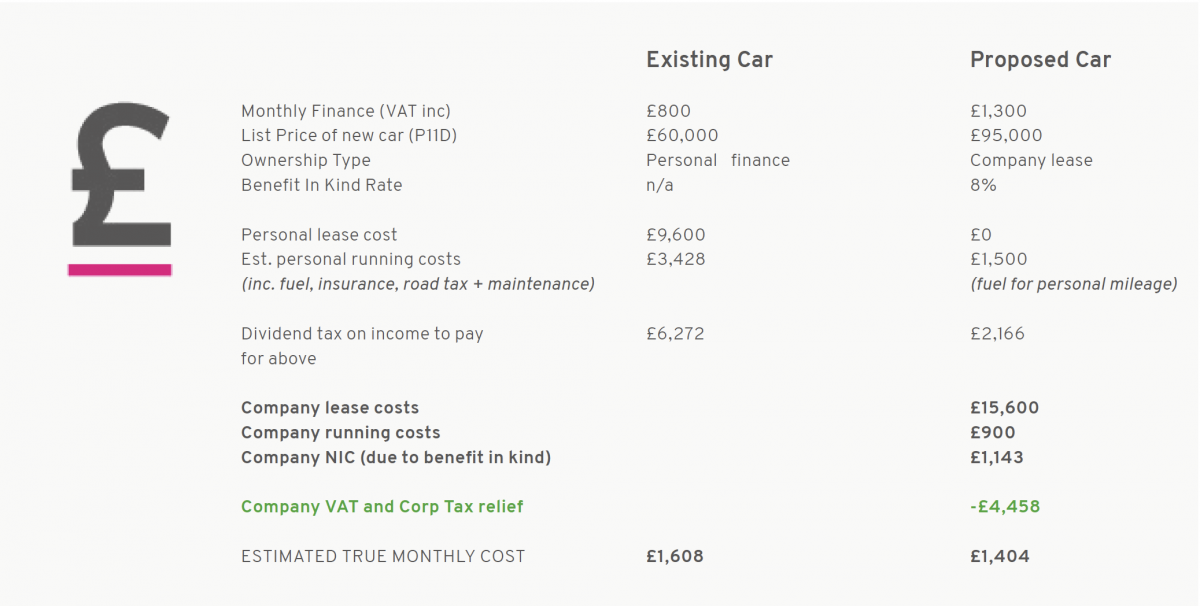

Tax Estimation:

The below calculations are based on the 2022/23 tax year, and assuming a Corporate Tax rate of 19%. We have made the assumption that, as a Director, your tax savings are based on dividend tax savings and VAT.

We're aware that many aren't quite ready to make a complete move to driving electric, and a hybrid car may be a good option for you. If you would like to arrange a time to chat to our expert EV team, simply complete the short form below and we'll give you a call back to discuss further.