EV prices are dropping. No, really. Car manufacturers are now offering major discounts on new electric vehicles, striving to boost demand as they face looming year-end sales targets, according to recent data.

The Government’s newly introduced Zero Emission Vehicle (ZEV) mandate requires carmakers to increase EV sales each year through 2030, with fines of £15,000 imposed for each electric vehicle sold below the set target.

In response, some manufacturers falling short of their 2023 quotas are reportedly cutting EV prices by amounts close to the financial penalties, aiming to accelerate sales. Let’s look into this news further and see what it means for you:

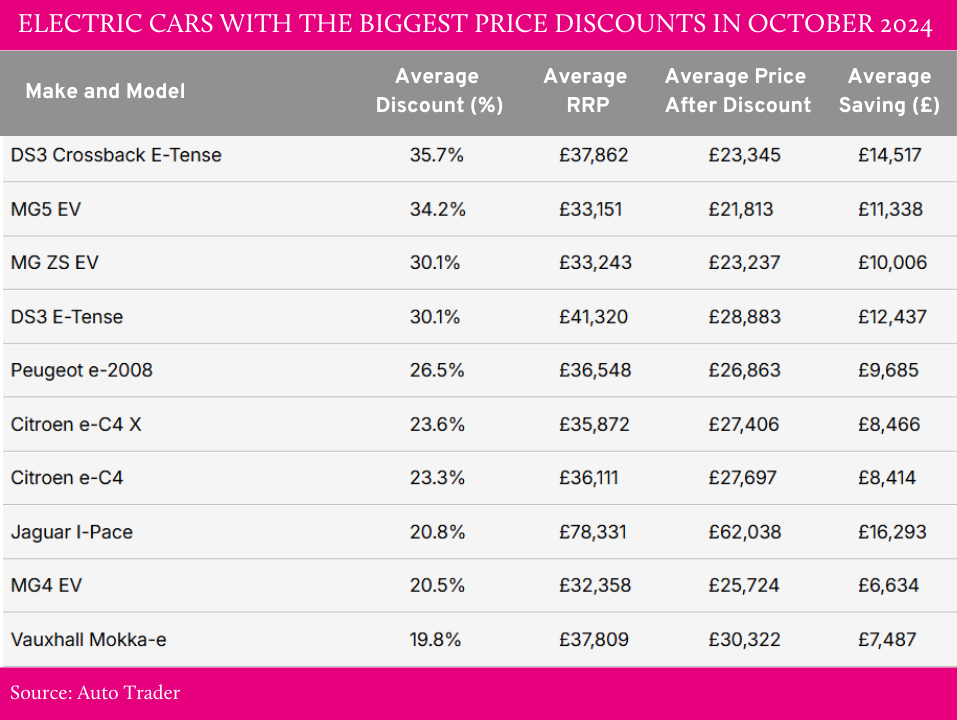

How big are these discounts?

Auto Trader’s recent analysis revealed that 70% of electric vehicles (EVs) on sale in October were offered with some level of discount. This figure is slightly lower than that for internal combustion engine (ICE) vehicles, where 76% of petrol, diesel, and hybrid models were sold below their advertised prices.

However, the average discount on EVs was significantly higher, at 12%, compared to just 8% for ICE vehicles. This trend reflects one of several strategies employed by manufacturers to meet the requirements of the ZEV mandate.

Not only that, but valuation specialists Cap Hpi have recently revealed that prices for new petrol and diesel vehicles have risen more sharply than EVs over the past year, as manufacturers pivot to launch more affordable battery-powered options.

With binding sales targets in place, manufacturers are expected to continue offering substantial discounts on EVs in the coming years to ensure compliance.

Remind me, what is the ZEV mandate?

Introduced in January of 2024, the ZEV Mandate specifies the minimum proportion of car manufacturers’ sales that must be zero-emission vehicles. This currently sits at 24% in 2024 but will rise to 80% by 2030 and 100% in 2035. Brands selling fewer than 1,000 ZEVs a year are exempt from the rules. This is effectively a ban on the sale of all new non-zero-emission cars by 2035.

However, discounts on EVs, which typically have RRPs around £5,000 to £10,000 higher than their petrol equivalents, are likely to stay for some time because the mandate’s thresholds increase each year from now until the end of the decade.

For 2030, the requirement is for 80 per cent of all new car registrations by brand to be zero emission EVs, the remaining 20 per cent allowance will only be for some types of hybrid car as our Labour Government has accelerated the ban on new petrol and diesel models to the end of the decade.

The ZEV mandate works on a credit-based system where manufacturers are awarded or stripped of credits if they overperform or underperform on the annual targets. Brands can choose to bank these credits for future years if they’re needed or can be sold to underperforming brands who need them to avoid fines. If a car maker beats their CO2 target (which is set individually for each brand) by reducing their CO2 emissions, then they can, for the first three years, convert this breathing room into ZEV credits at an exchange rate.

Looking at 2024 so far, EV market share is just 18.1% – almost four percentage points shy of the ZEV mandate’s 22% threshold. With just two months of the year left to hit the target, it is no surprise that experts are predicting more price cuts before the end of the year.

According to the Society of Motor Manufacturers and Traders, EVs accounted for over 20% of all passenger car registrations in October 2024!

EV prices aren’t just falling, they’re getting cheaper

As some manufacturers scramble to meet the impending requirements of the ZEV mandate, discounts on electric vehicles (EVs) don’t look like they’re going away. However, there is growing evidence of brands also introducing more affordable EVs to the market.

Earlier this year, Dacia unveiled its new Spring EV to the market, with a starting price of £14,995. Yes, you read that right. Other notable budget-friendly models include the newly-electrified Renault 5 priced at £22,995 and Citroën’s £21,990 e-C3.

The emergence of these more reasonably priced EVs, coupled with the phasing out of cheaper ICE cars like the Ford Fiesta and VW Up, is starting to reshape the market. Additionally, an influx of competitively priced EVs from Chinese manufacturers like BYD is playing a key role in driving down the average retail price of electric cars.

Last year, new car prices increased across the board, with average rises of £2,134 for petrol vehicles, £2,043 for diesels, and £2,753 for EVs. However, 2024 has seen a noticeable change in this trend.

Petrol car prices have risen by an average of £1,876 this year, and diesels by £1,221. EV prices, however, have experienced the slowest growth, increasing by just £1,159 on average. According to Cap Hpi, annual EV price increases are now slowing more significantly (3.91%) compared to petrol (1.28%) and diesel (1.66%) vehicles.

Do these price drops mean now is the time to switch to electric? There’s no denying it’s something to consider. Luckily, if you’re thinking about making the switch, our team of EV experts can help you every step of the way. Feel free to get in touch with our team below and we can help you drive away in the right car for you.