As the world marches on through the digital age, new ways to buy, lease and drive cars continue to emerge. One of these new ways is the online leasing platform. Websites like Leasing.com and LeaseLoco have 1000s of people coming through their digital doors every day to buy new cars without ever getting up out of their chairs, which can be quite daunting to those used to the traditional trawling around a dealer forecourt on their day off.

At first glance, these platforms seem like a great way to get a good deal, but are they really offering the best service?

In this blog, we’ll break down how an online leasing platform works, and what you should consider before signing on the dotted line.

How does an online vehicle leasing site work?

You may think that this is simply the dealership model being carried into the digital age, but this is not the case. The reality is that most of these platforms function as advertising marketplaces rather than full-service leasing providers. The real leasing companies (either brokers or dealerships) pay a fee to these online platforms to advertise their deals on these platforms.

While they display an array of attractive deals, their role is limited to generating leads for brokers or dealerships. They simply showcase deals from those who have paid to be listed on their platform.

Once you’ve signed the lease contract, the level of service and support you receive depends entirely on the broker or dealer. The platform can wash its hands of you and offer no ongoing support.

Think of these sites as a kind of “Compare the Market” for leasing. Just like buying car insurance through a comparison website, the platform itself doesn’t provide the product, it just directs you to the cheapest option. The broker or dealer you end up with may not prioritise customer experience, as their margins are typically razor-thin.

Online leasing platforms also promote the Personal Contract Purchase (PCP) finance model to customers over others, as this is where their commission is more attractive. While this model has nothing inherently wrong with it, it can lead to bigger monthly payments and a painful Balloon payment at the end. The Personal Contact Hire (PCH) is what we recommend for our customers. You can find out more about the difference in these models here.

3 things to watch out for before you purchase

A lot of this might sound appealing, but there are a few questions you should ask yourself when considering an online leasing site. These include:

What’s the real price? – Many online lease deals advertise rock-bottom prices to attract the most eyes. However, these deals often have hidden costs, such as high admin fees or strict terms that may not suit your needs. If you can’t find the answer, it may be best to look elsewhere.

Who is actually leasing the car? – Before committing, find out who will be handling your lease agreement. The site itself doesn’t provide the car or service—you’ll be dealing with the broker or dealer they connect you with. Do your research on them. Are they known for their customer service? Do they have your best interests at heart?

What does the aftercare plan look like? – If something goes wrong, whether it’s delivery delays or contract amendments, you’ll have to rely on the broker’s customer service, which can vary significantly. They might not even have any!

Is cheapest always best?

Cars have endless choices of engines, specifications, interiors, alloys and driver conveniences, but the most important aspect will always be the price. While it’s always appealing to go for the cheapest option available, pricing behind a new car is complex and can carry a huge amount of risk.

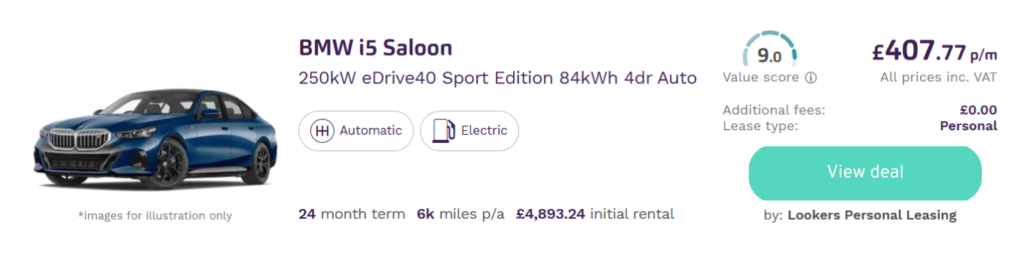

Here is what a deal on an online leasing site might look like. Most of us will focus on the attractive monthly price, as you would. Now use the 3 questions above to examine this deal. Admittedly, you can only learn so much from one image, but even the information shown here after a brief look shows that it’s not as simple as a cheap monthly payment.

The “stack-‘em-high, sell-‘em-cheap” approach that online leasing platforms take works for some things, but is it right for a multi-year financial commitment like a vehicle lease? Would you trust a £50,000 car lease to a company making £100 from the deal?

It’s like choosing between Ryanair and a more premium airline. Ryanair might be fine for a last-minute city break, but is it the best option for a long-haul family holiday? For customers who want reliability, support, and quality service, a full-service provider offers peace of mind that any online marketplaces simply can’t match.

Hang on, aren’t you an online vehicle leasing website?

In some ways, yes. In most ways, no.

At P+B, we take a fundamentally different approach. Instead of simply being a lead-generation machine, we offer end-to-end service, meaning the price you see on our website comes with a complete customer experience.

With online leasing sites, once your car is delivered, your relationship with them is over. With us, that’s just the beginning. Our award-winning Client Services team support our clients from minor contract amendments to end-of-lease returns.

We have created a business model that isn’t about selling the cheapest or most expensive lease, as our commission is structured in a way that keeps it the same for every car.

The goal isn’t just to sell you a lease, it’s to make sure you get the right car, on the right terms, with the right level of support. We don’t just say this because it sounds nice, it’s the whole reason we were founded in the first place. It’s about forming a partnership with our clients rather than ending our relationship at the point of purchase.

Save you from the endless trawling of dealerships and online sites. Take the stress off your plate. That’s how car buying should be.

Interested in leasing a car with real service and support? Get in touch today, we’d love to help.