Written by Bethany Weir

Increases to Vehicle Excise Duty (VED) will be coming into effect from the 1st of April. These changes are set to impact all drivers, regardless of what kind of car they own.

You may see your monthly costs go up as a result of this, which can be frustrating. Let us explain these changes further to work out how they will directly affect you.

What are the changes?

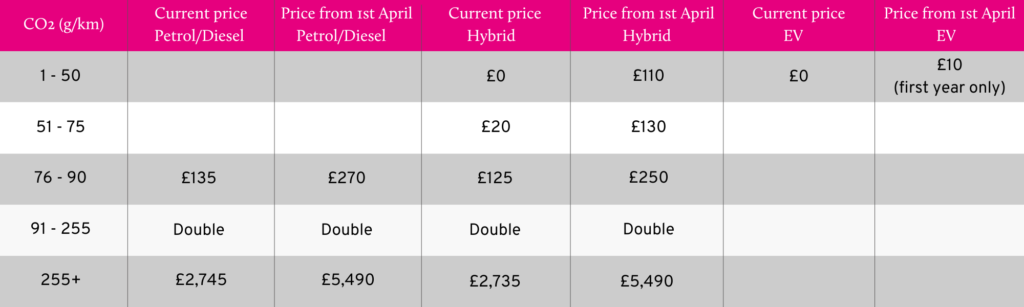

Here is a summary of the changes coming to VED (otherwise known as road tax) from April 1st onwards:

- Electric vehicles (EVs) will no longer be exempt from VED. EVs registered on or after 1st April 2025 will pay the lowest first-year VED rate, currently set at £10. From the second year onwards, EVs will move to the standard rate of £195 per year.

- EVs registered between April 1st, 2017, and March 31st, 2025, will now be required to pay the standard VED rate of £195 per year, aligning them with all other motorists.

- Cars emitting between 1-50 g/km of CO2, primarily plug-in hybrids, will see their first-year VED increase to £110, whereas they previously paid nothing.

- Cars emitting between 51-75 g/km of CO2, the first-year tax will rise from £30 (or £20 for hybrids) to £135.

- Standard VED rates for beyond the first year will rise in line with the Retail Price Index (RPI) as is normally the case.

How do I pay?

For our Personal Contract Hire (PCH) and Business Contract Hire (BCH) customers, your finance company will be responsible for paying the VED, as they are the owner of the vehicle. You will see a rise in your monthly costs because of this. Your funder should have been in touch regarding this.

For our clients who own their vehicle through Personal Contract Purchase (PCP) or a cash purchase, you’ll have to register your vehicle if you haven’t already done so. The easiest way to do this is online by clicking here.

Regardless of if you own or lease your vehicle, the amount you pay will be the same.

How much do I need to pay?

From April 1st 2025, the standard flat rate for car tax will rise to £195 per year. Hybrid vehicles will receive a small discount of £10, reducing their annual tax to £185.

However, if your car had a list price exceeding £40,000 when first sold, you will also be subject to the Expensive Car Supplement surcharge, which adds £425 per year to your VED costs.

The exact amount of VED you owe depends on when your car was first registered and the type of fuel it uses. If your vehicle was first used before 2017, your annual tax may be higher or lower depending on its CO₂ emissions.

Here is a table comparing the first-year price charges across all vehicle types.

Petrol, Diesel, Hybrid and VED

Petrol and diesel vehicles will also face higher road tax rates, particularly those with higher CO₂ emissions. The more emissions your car produces, the higher your annual tax, which will be factored into your lease costs.

Hybrid vehicles will continue to receive a £10 discount in the first year, but from year two onwards, they will be taxed at the standard rate of £195 per year, plus any additional charges based on emissions, similar to petrol and diesel cars.

Electric vehicles and VED

Currently, EVs are exempt from road tax, but this will change on 1st April when VED charges will apply to EVs for the first time.

With EVs losing their exemption from VED, you might assume EVs aren’t as cost-effective as they once were. The reality is quite the opposite. With VED for petrol and diesel vehicles increasing by an even greater amount, in some cases even doubling, switching to an electric car brings an even bigger cost benefit to drivers.

Add on the benefits of lower Benefit-in-Kind (BiK) rates, reduced fuel costs, and exemptions from congestion and ULEZ charges in many areas, and it’s clear the financial savings you can make with an EV are not to be ignored.

The full list of bands can be found here.