11 Feb 2025

Transparency has often been difficult to find when purchasing or leasing a vehicle in the automotive world. This creates frustrating buying experiences that leave customers feeling drained. Although the Court of Appeal ruling to disclose commission to customers in 2024 provided some positive news, the industry still has a ways to go.

We’ll let you in on a little secret: We’ve disclosed our commission to our clients since the beginning! Ever since our first customer walked through our doors all those years ago. This proactive stance underscores our dedication to integrity and is core to our mission of cleaning up the car industry.

So, how does it work?

In this article, we’ll walk you through how our commission system works, how it compares to conventional models, and why it ultimately benefits you, the customer.

How do we structure our commission?

At the core of our business, we’ve always championed a transparent and straightforward commission structure. Since we were founded in 2013, inspired by the Retail Distribution Review (RDR) for Independent Financial Advisors (IFA), we’ve disclosed our commissions to customers. Think of us more like a Mortgage broker than a car dealer in that sense.

Firstly, our Relationship Managers receive fixed commissions for all vehicles. Doesn’t matter if you opt for a Ford or a Ferrari, it’s always the same (a Ferrari would be cooler, but you get the idea). We’ll never try to upsell you unless we genuinely believe that would be the better option.

Secondly, unlike some brokers and dealerships, we don’t operate under pressure to offload stock or meet sales quotas tied to bonuses. Unfortunately, our industry is notorious for prioritising stock cars over factory orders to expedite their commissions. We do things differently, and this is an example of that.

Lastly, we typically pay 30-40% higher base salary than the industry, meaning when you deal with one of our Relationship Managers, you can be far more confident they can have your best interest at heart.

This is the same across all of our services, from our Personal Leasing clients to Business Fleets. For our EV Salary Sacrifice clients, while the process involves more administrative work, like setting up agreements with employers and managing ongoing operations, the fixed commission structure remains unchanged.

How does this differ from the usual commission structure?

In many traditional dealership or leasing scenarios, customers often face a different reality. A car salesperson’s commission is usually a percentage of the net profit made from a car sale. For example, if a car salesperson sells a car for £25,000 and the dealership makes a £7,000 profit, the salesperson would earn £1,400 if their commission rate is 20%.

We want to be clear when we say that there is nothing inherently wrong with this, but this can become a catalyst for bad practices if led by the wrong person.

Meanwhile, online brokers often commit to bulk-purchasing certain vehicles and prioritising those over others. Pricing and recommendations are also frequently influenced by backend targets or bonus incentives, leaving customers with fewer unbiased choices.

As most of you will be aware, the car industry holds a negative reputation in the minds of many. While progress has been made, there’s still a long way to go.

Regarding the recent changes to the industry

As of October 25th 2024, the Court of Appeal ruled that it was unlawful for two lenders to have paid a “secret” commission to car dealers without the borrowers’ knowledge. Our industry must now disclose commissions to customers and obtain their explicit consent before any financing is arranged.

This undoubtedly placed financial and operational strain on many brokers and dealerships, with some even dubbing it ‘PPI 2.0’. Even the industry giants, such as the leading investment group Close Brothers, face a looming crisis in the coming months.

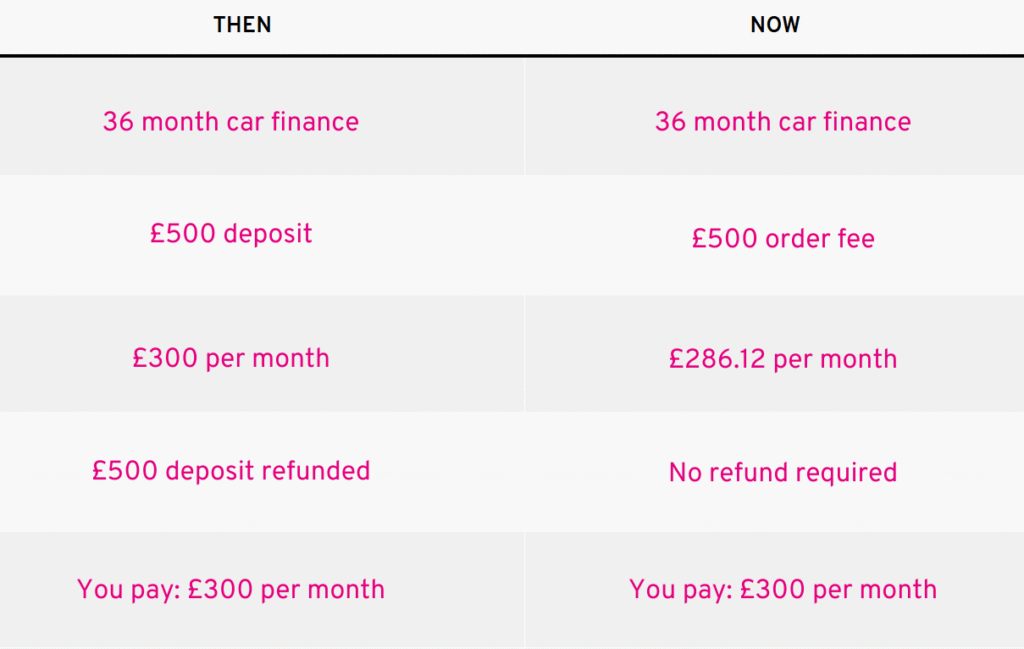

Thankfully, this didn’t affect us as much as others, as we’ve been ahead of the curve when it comes to transparent practices. A key shift we did adopt following this change is collecting order fees upfront rather than refunding them later. Don’t worry, the amount you will pay hasn’t changed, but this practice is now more rooted in our commitment to integrity and customer-centricity.

Here’s a rough example of what this looks like:

What does this mean for you?

Our commission model was designed with you in mind, ensuring fairness and clarity at every step. We have always felt we lagged behind our FCA-regulated equivalents, and this realisation drove us to do the right thing and be the good guys in the industry.

Combine this with our integral ‘Fact Find’ conversations, and you’ve got a business model that puts the customer above all else. We may sell really nice cars, but what interests us far more is the people who drive away in them.

If you have any further queries about our commission structure, feel free to reach out. We’re here to help!